SALES COMMENTARY

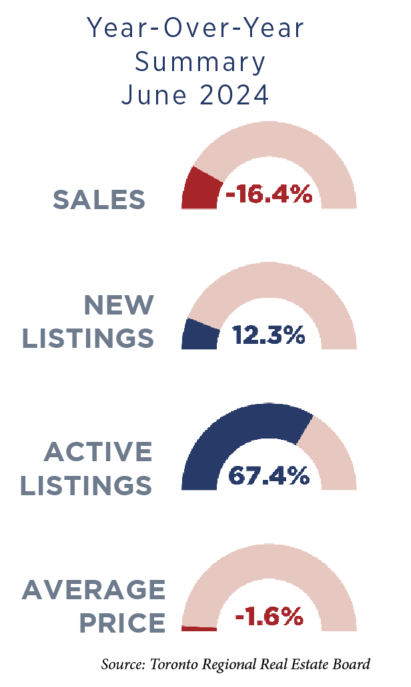

The Toronto real estate market in June 2024 showed mixed signals, reflecting ongoing adjustments to changing economic conditions and inventory levels. There was both optimism and concern regarding the imminent interest rate cut. Optimism stemmed from the clear monetary signal that interest rates are on the decline, creating confidence and potentially bringing more buyers off the sidelines. Conversely, there was concern that a reduction too soon might spur the real estate market with renewed activity and lead to a run-up in values. The reality is that the interest rate reduction in June had no immediate impact on buyer confidence. It was clear that more interest rate reductions are needed for improved affordability. The continued decline in sales activity evidenced a cautious “wait and see” approach from buyers, while inventory levels continued to rise as sellers anticipated more interest.

The Toronto real estate market in June 2024 showed mixed signals, reflecting ongoing adjustments to changing economic conditions and inventory levels. There was both optimism and concern regarding the imminent interest rate cut. Optimism stemmed from the clear monetary signal that interest rates are on the decline, creating confidence and potentially bringing more buyers off the sidelines. Conversely, there was concern that a reduction too soon might spur the real estate market with renewed activity and lead to a run-up in values. The reality is that the interest rate reduction in June had no immediate impact on buyer confidence. It was clear that more interest rate reductions are needed for improved affordability. The continued decline in sales activity evidenced a cautious “wait and see” approach from buyers, while inventory levels continued to rise as sellers anticipated more interest.

This chart plots Monthly MLS® Sales-To-New Listings Ratio for the current year and the previous three years. A Balanced market is when the ratio sits between 0.4 and 0.6. The current SNL Ratio indicates we are in a Buyer's Market.

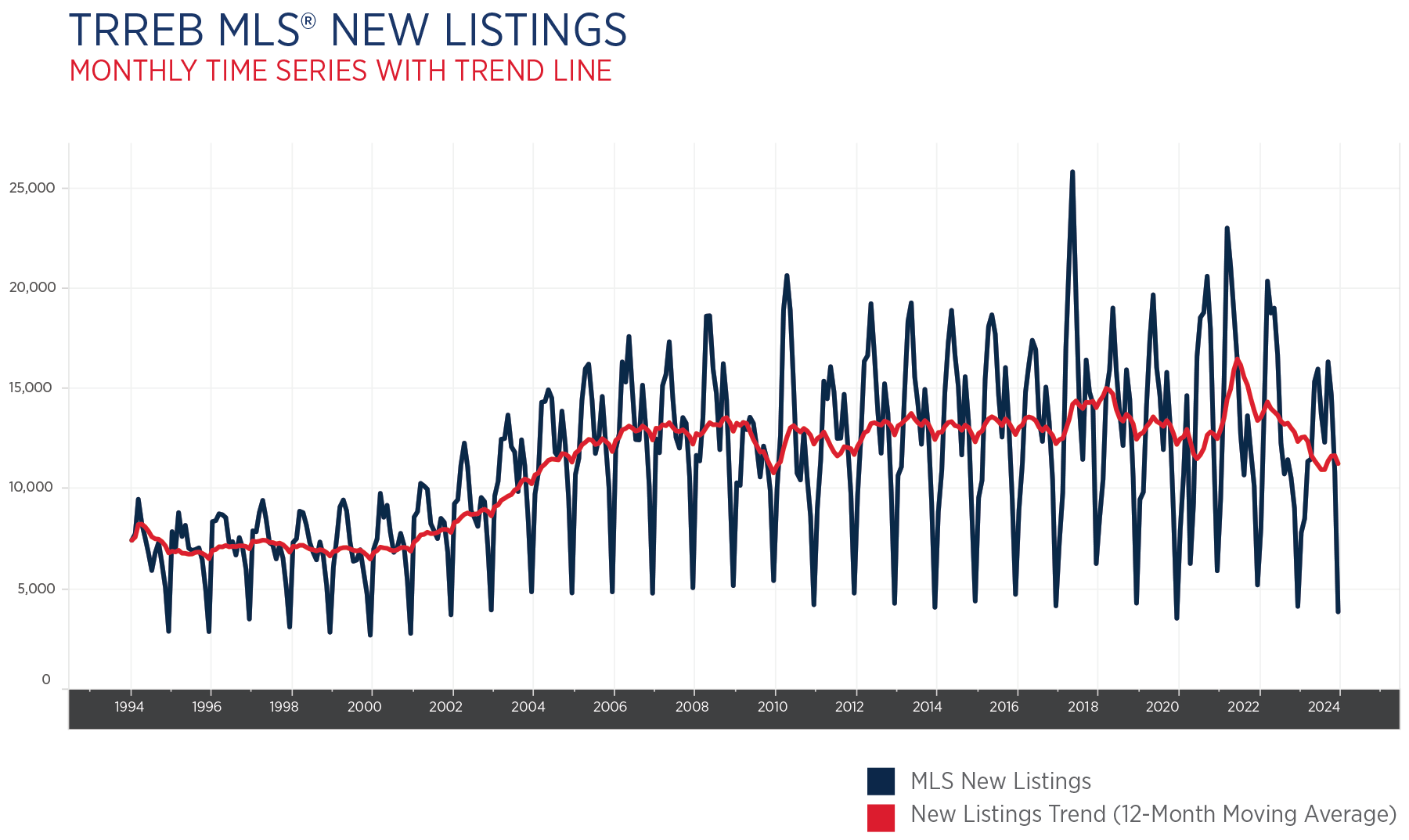

SALES & LISTING TRENDS

The market showed notable trends in sales and listings. In Toronto, performance varied across different neighborhoods and housing types. The average home price was $1,173,781, representing a 1.6% month-over-month decrease but a 1.9% increase year-over-year. Homes that are renovated in established and mature neighbourhoods, traditionally insulated from economic fluctuations, remained in demand and continued to sell fast, often with multiple offers. However, these did not necessarily reflect sales prices over the asking price.Other regional GTA neighbourhoods performances varied. To the north; King, Whitchurch-Stouffville, and Aurora saw significant year-over-year price increases of 11.6%, 8.9%, and 7.2%, respectively. Conversely, areas like Brampton, Caledon and Pickering experienced substantial price declines of 9.3%, 15.2% and 12.1%, respectively.

Source: Toronto Regional Real Estate BoardCONDO MARKET

The condo market experienced a significant decrease, with a 29% year-over-year drop in sales while inventory continued to swell. The average days on the market for a condo increased from 19 days in June 2023 to over 30 days in June 2024. The slower market conditions in the condo market are currently providing more leverage for buyers. Looking ahead, as freehold homes continue to increase in value and when interest rates decrease further, more first-time buyers are expected to enter the condo market, absorbing the present inventory.

CONDO MARKET

The condo market experienced a significant decrease, with a 29% year-over-year drop in sales while inventory continued to swell. The average days on the market for a condo increased from 19 days in June 2023 to over 30 days in June 2024. The slower market conditions in the condo market are currently providing more leverage for buyers. Looking ahead, as freehold homes continue to increase in value and when interest rates decrease further, more first-time buyers are expected to enter the condo market, absorbing the present inventory.SUMMARY

The Toronto real estate market in June 2024 exhibited a strong shift towards a traditional seasonal summer market and a buyer’s market with increasing new listings and cooling prices, while still maintaining relatively quick sales for move-in ready properties in desirable neighbourhoods. The rental market showed stability with minor fluctuations in rental rates across different apartment sizes. Buyers and sellers alike continue to adjust to ongoing economic conditions, particularly in response to interest rate trends and market dynamics.