SALES COMMENTARY

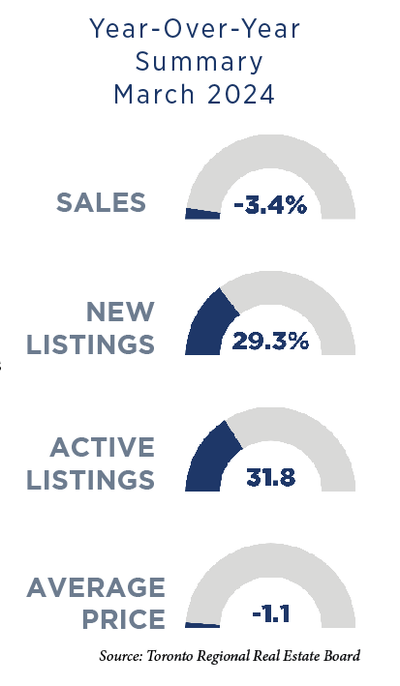

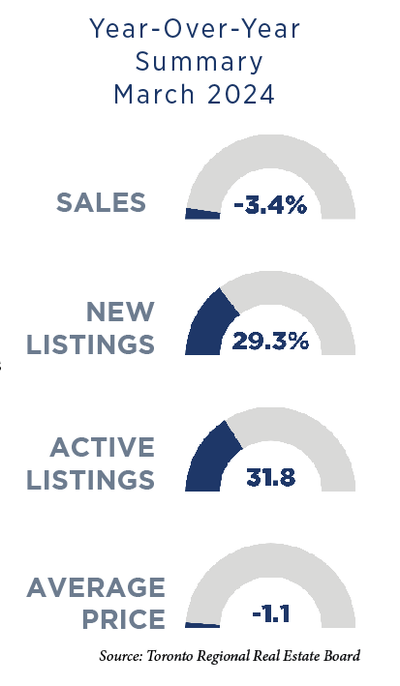

While stats seem to demonstrate that the market is experiencing renewed vibrancy, buyers and sellers have had a cautiously optimistic approach in the month of March. It’s clear that not all segments of the market are performing the same way and the politicization of real estate has been a cause for concern as it sends mixed messages to consumers.

While stats seem to demonstrate that the market is experiencing renewed vibrancy, buyers and sellers have had a cautiously optimistic approach in the month of March. It’s clear that not all segments of the market are performing the same way and the politicization of real estate has been a cause for concern as it sends mixed messages to consumers.

The Canadian Mortgage and Housing Corporation (CMHC) recently indicated that prices could reach and exceed the peaks of 2022 by 2025. Sellers who can afford to do so may wait on the sidelines in anticipation of a higher selling price. This, and the decline of housing and condo starts will only continue to contribute to low supply, resulting in future demands not being met when lower borrowing costs arrive.

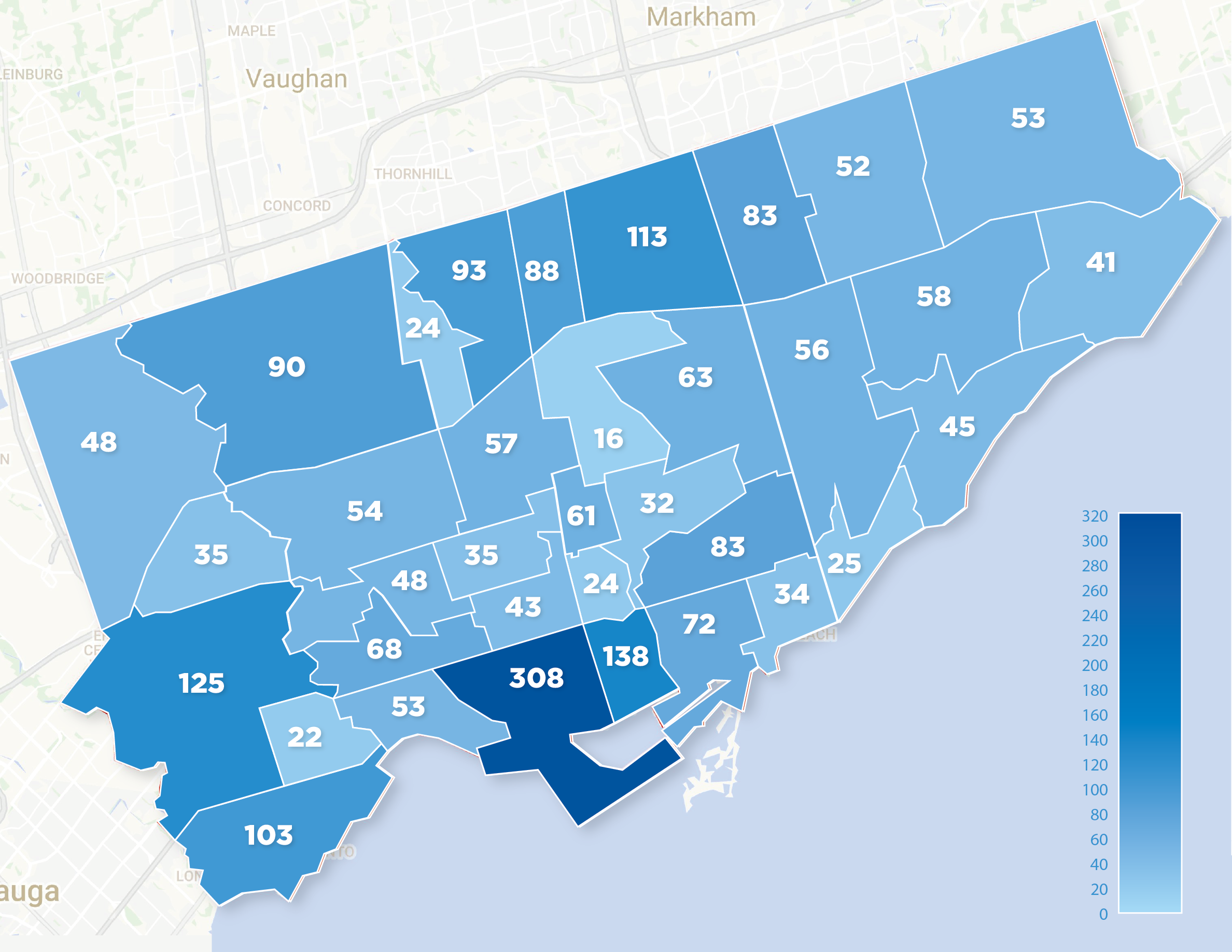

Freehold real estate continues to be the focal point. It’s important to recognize that homes in the established, more desirable neighbourhoods of Toronto have continued to outperform other parts of the GTA. While listings did generally increase in those neighbourhoods, there are other neighbourhoods that have continued to experience low supply. When properties do hit the market in the latter, it’s common to see multiple offers.

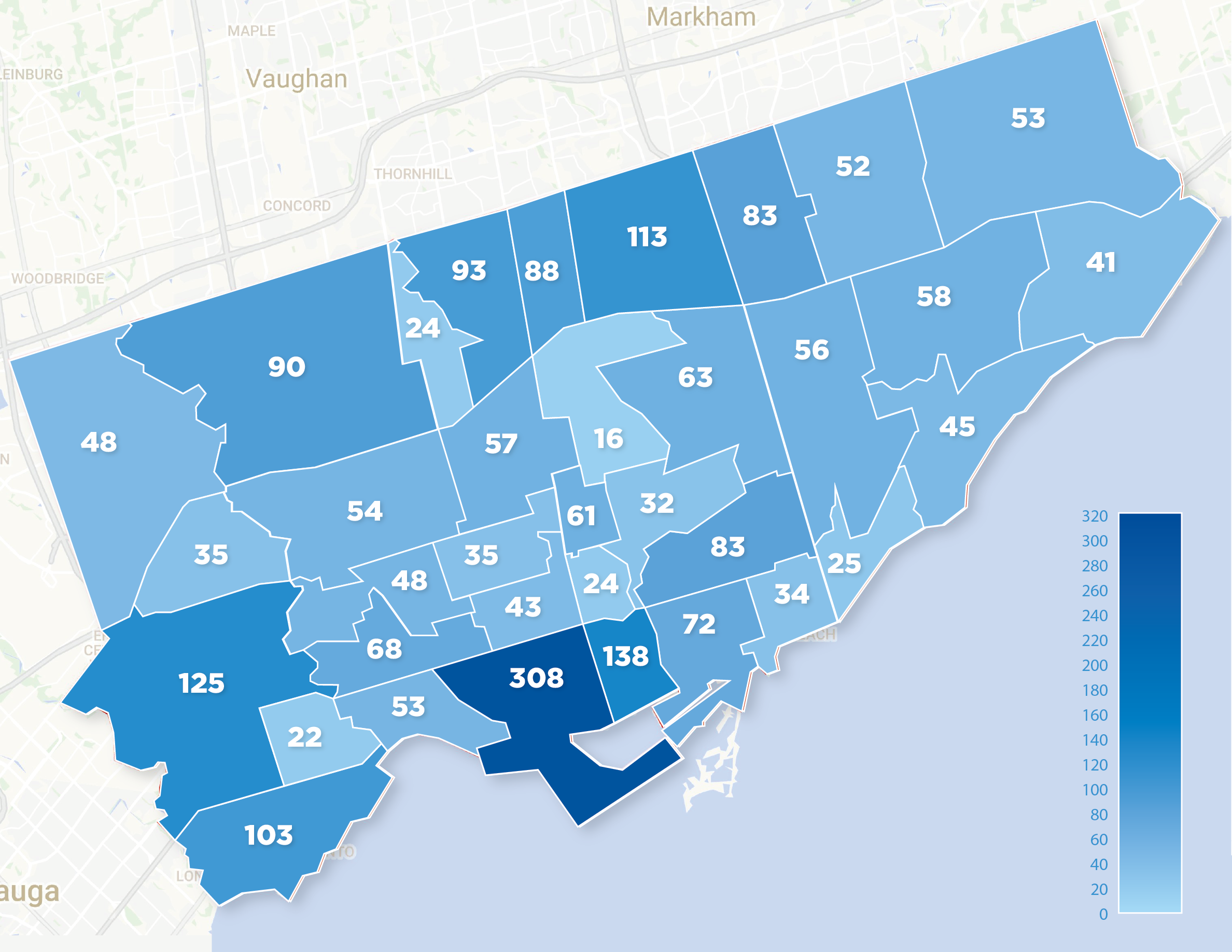

This map plots the number of sales segmented by Toronto Neighbourhood for the Month of March 2024

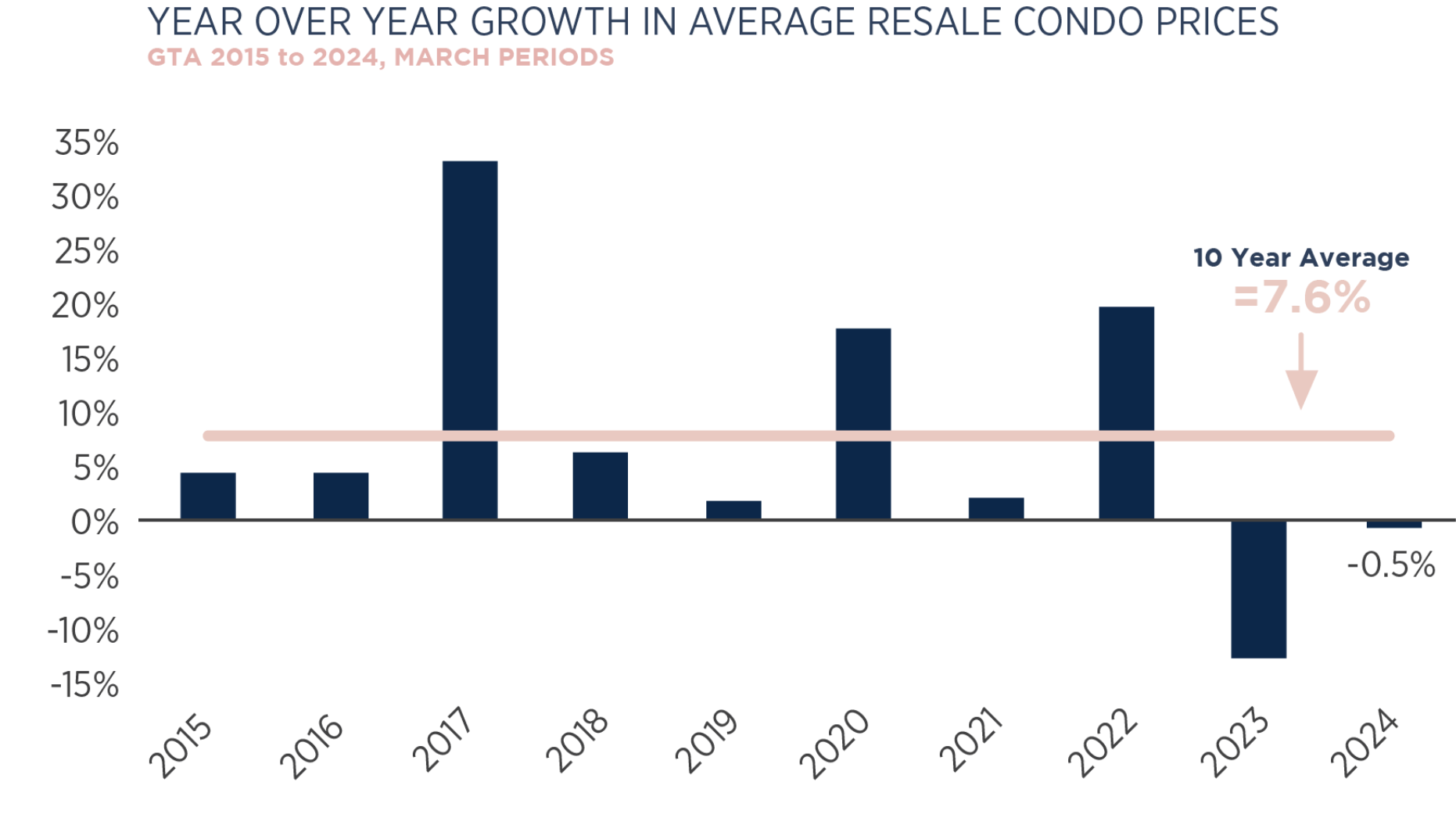

PRE-CONSTRUCTION AND CONDOS

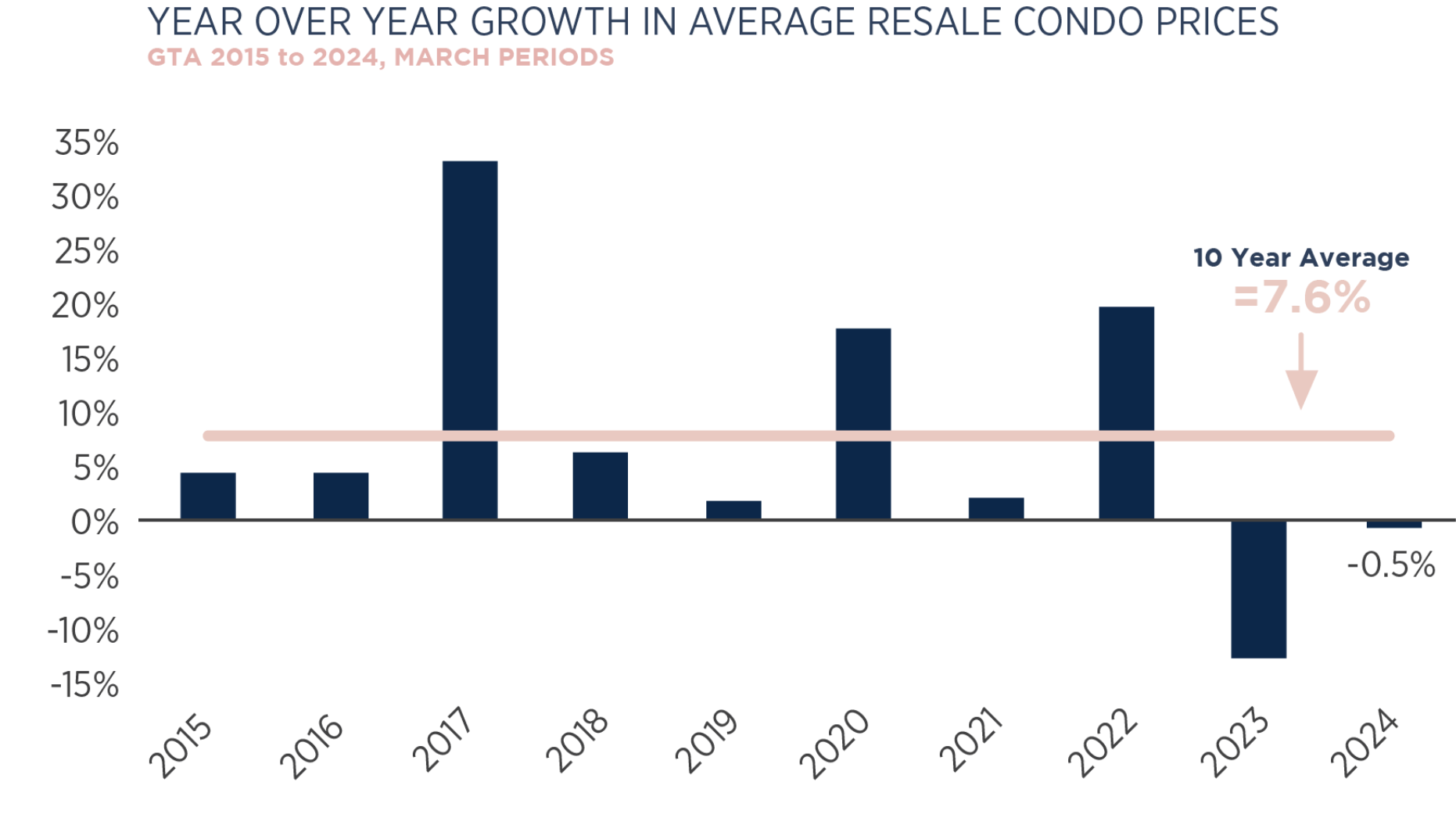

The pre-construction condo market continues to experience the most volatility as it works through its unsold inventory and new condos due to close. As interest rates rapidly increased, timing could not have been worse for the significant number of investors who have been relying on the assignment market to sell their units - many of whom have been willing to sell their units before they close for what they paid or lower. This volatility will continue until interest rates and borrowing costs begin to decline. As this happens there will be less and less assignment sales and these buyers will likely choose to close.

The resale condo market has continued to drag behind freehold homes with sales decreasing by 13% and inventory increasing to a 9-year high. It’s interesting to note that prices increased by 0.7% month-over-month and the months of inventory in March dropped to 3.2 from the 5.5 months of inventory it had in November 2023. As freehold home prices continue to increase, first-time buyers will begin to revisit the condo market, causing the inventory to start being absorbed. This will be a short window of opportunity for first-time buyers and investors.

While stats seem to demonstrate that the market is experiencing renewed vibrancy, buyers and sellers have had a cautiously optimistic approach in the month of March. It’s clear that not all segments of the market are performing the same way and the politicization of real estate has been a cause for concern as it sends mixed messages to consumers.

While stats seem to demonstrate that the market is experiencing renewed vibrancy, buyers and sellers have had a cautiously optimistic approach in the month of March. It’s clear that not all segments of the market are performing the same way and the politicization of real estate has been a cause for concern as it sends mixed messages to consumers.The Canadian Mortgage and Housing Corporation (CMHC) recently indicated that prices could reach and exceed the peaks of 2022 by 2025. Sellers who can afford to do so may wait on the sidelines in anticipation of a higher selling price. This, and the decline of housing and condo starts will only continue to contribute to low supply, resulting in future demands not being met when lower borrowing costs arrive.

Freehold real estate continues to be the focal point. It’s important to recognize that homes in the established, more desirable neighbourhoods of Toronto have continued to outperform other parts of the GTA. While listings did generally increase in those neighbourhoods, there are other neighbourhoods that have continued to experience low supply. When properties do hit the market in the latter, it’s common to see multiple offers.

Toronto MLS Sales by Neighbourhood

March 2024

PRE-CONSTRUCTION AND CONDOS

The pre-construction condo market continues to experience the most volatility as it works through its unsold inventory and new condos due to close. As interest rates rapidly increased, timing could not have been worse for the significant number of investors who have been relying on the assignment market to sell their units - many of whom have been willing to sell their units before they close for what they paid or lower. This volatility will continue until interest rates and borrowing costs begin to decline. As this happens there will be less and less assignment sales and these buyers will likely choose to close. The resale condo market has continued to drag behind freehold homes with sales decreasing by 13% and inventory increasing to a 9-year high. It’s interesting to note that prices increased by 0.7% month-over-month and the months of inventory in March dropped to 3.2 from the 5.5 months of inventory it had in November 2023. As freehold home prices continue to increase, first-time buyers will begin to revisit the condo market, causing the inventory to start being absorbed. This will be a short window of opportunity for first-time buyers and investors.

RENTAL COMMENTARY

The bright light for tenants is that condo rental listings continued to outstrip lease transactions providing more choice, causing rental rates to experience a modest downward pressure. On average, rents have gone down by 7.3% but don’t anticipate a further decline as the market still has only 1.4 months of inventory.