SALES COMMENTARY

Sales on the Toronto Regional Real Estate Board were 7481 in June. We are supposed to be excited that they were 16% higher than June of 2022. But they were also down 17% from May. In fact, June sales are lower than the previous 4 years.

Sales on the Toronto Regional Real Estate Board were 7481 in June. We are supposed to be excited that they were 16% higher than June of 2022. But they were also down 17% from May. In fact, June sales are lower than the previous 4 years. At the mid-point of the year, we are now forecasting 73,000 sales for the year. This is based on the historical fact that the first 6 months usually account for 53% of the year’s sales. If we only reach this number, sales will be the lowest since 2002. To make matters worse, the market served by TRREB is considerable larger today than in 2002. That means comparable sales are even lower.

What has been saving real estate prices is the lack of listings. But as sales have slowed, we are seeing more listings coming to market. Yes, owners are always a month late. For June the sale-to-new listing ratio was at 47%. From February through to May, the numbers were: 57%, 62%, 66%, and 59%. At 47%, with a chance to go lower over the summer, expect to reach a ‘buyers’ market’ and flat to lower prices. The market will only pick up when the Bank of Canada signals that there will be no more rate increases in this business cycle.

THE MYTH ABOUT AVERAGE PRICES

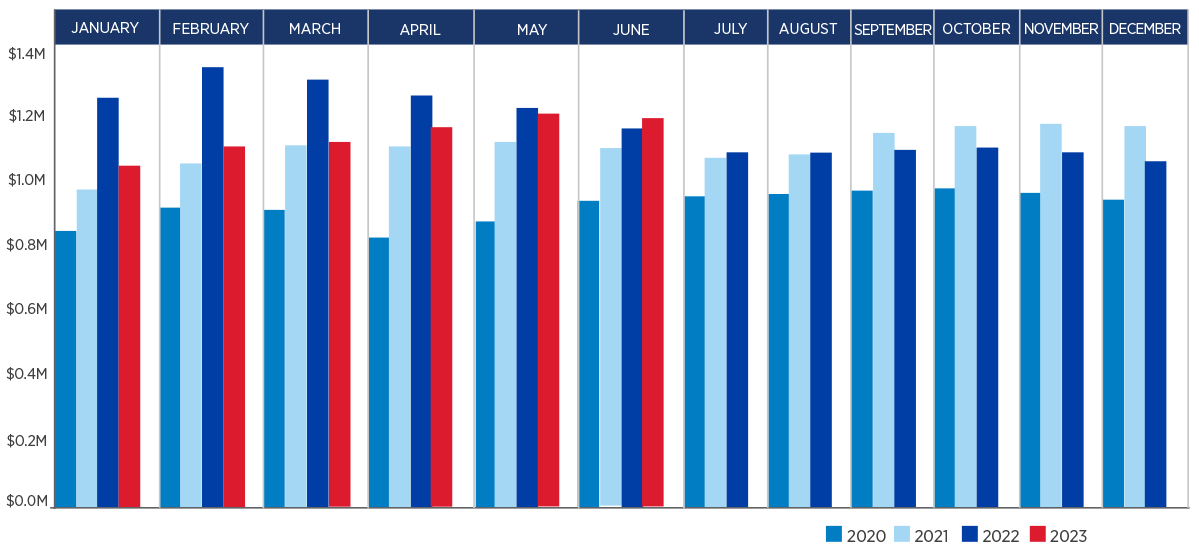

Do you ever wonder why monthly average prices are higher in the spring than the fall? See the graph below over the last four years. The answer is not that prices are falling but just that the mix of sales changes over the year. In the spring more expensive properties sell than in the fall. These properties are usually detached and are owned by older families who are moving at the end of the school year. Single people and couples tend to move more uniformly through out the year. Young people moving tend to predominate at the end of the year.TORONTO MLS AVERAGE PRICE

THE CONDO MARKET

There is currently a disconnect between pre-construction and the resale condo prices. Pre-construction always commands a premium (never lived in, new features, etc.) But how big a premium should there be? If the premium is less than $100 psf, then most buyers opt for pre-construction. Unfortunately, the gap in Toronto itself is $400 psf. That is why most of the new projects are in the 905 and in smaller towns such as Brantford, Niagara Falls, and even Woodstock. There you can buy for under a $1,000 psf which is what the resale price is in Toronto. The problem with these smaller markets is: can you find local buyers/end users at these prices when it comes time to resell? Or can you find renters at $2500 per month? The answers will come in 3 years.Currently we are seeing many buyers of pre-construction units from 3 and 4 years ago unable to get a mortgage and hence close today. These buyers are then forced into the Assignment Market – selling a property before it is registered. Assignments are hard to market, and the paperwork can be more complicated than just a regular resale. At the outset, many of these buyers, now forced to sell, set unrealistic listing prices. When the closing date gets under 30 days, these buyers become desperate to recover some or most of their deposits. This is when the best deals can be found. But you need to work with an agent who knows this market.TORONTO MLS SALES

RENTAL COMMENTARY

In June almost 2400 condos were leased versus 2200 in May for the Downtown and Humber Bay markets. The peak for the rental market should come in either July or August. In comparison, the sales peak for the year was in May.When the Federal Government encouraged record immigration (one million plus), and when you have a law that only permanent residents and citizens can buy residential real estate in Toronto, there is only one market left – renting. We are starting to see these new immigrants pay anywhere from 6-12 months rent in advance to secure a unit. Blame this on your Government.Rental prices moved higher for small units this month. Bigger units were unchanged in rent from May. The table below represents average rents by bedroom types, but extras for parking ($300) and a second bathroom ($500) need to be taken into account.