SALES COMMENTARY

Looking at March numbers is like looking in the rear-view mirror. Sales at 11,000 units were down 30% from March a year ago which was the biggest sales month in 2021. Our guess is that March this year will be the biggest sales month of 2022.

Looking at March numbers is like looking in the rear-view mirror. Sales at 11,000 units were down 30% from March a year ago which was the biggest sales month in 2021. Our guess is that March this year will be the biggest sales month of 2022.Everyone wants to know what will happen for the balance of the year. As you recall, we forecast a market ‘pause’ for April back in January and this is what we are experiencing. This pause was caused by rising interest rates, buyer fatigue, and a misunderstanding of the new real estate changes brought on by the Federal Government Budget. The first two points are very real but when people sort out the new Government proposals, they will realize it is much ado about nothing.

Let’s deal with rising interest rates first. No matter what the Bank of Canada says, they are not going to go much ahead of the U.S. for fear that a rising dollar will make our economy even less competitive. Our guess is that the U.S. will move very cautiously in raising interest rates and we will see an end to any increases by the end of the year.

Buyer fatigue is very real and is caused by buyers losing out in multiple offer scenarios and some winners sharing their buyers’ remorse with friends. The good news is that listings are now starting to increase. While ‘active’ listings are almost identical to last year now, the slow down in sales will soon create a satisfactory pool of listings for buyers. This balance will be achieved by June.

In summary, we expect the market to return to normal sales activity by September.

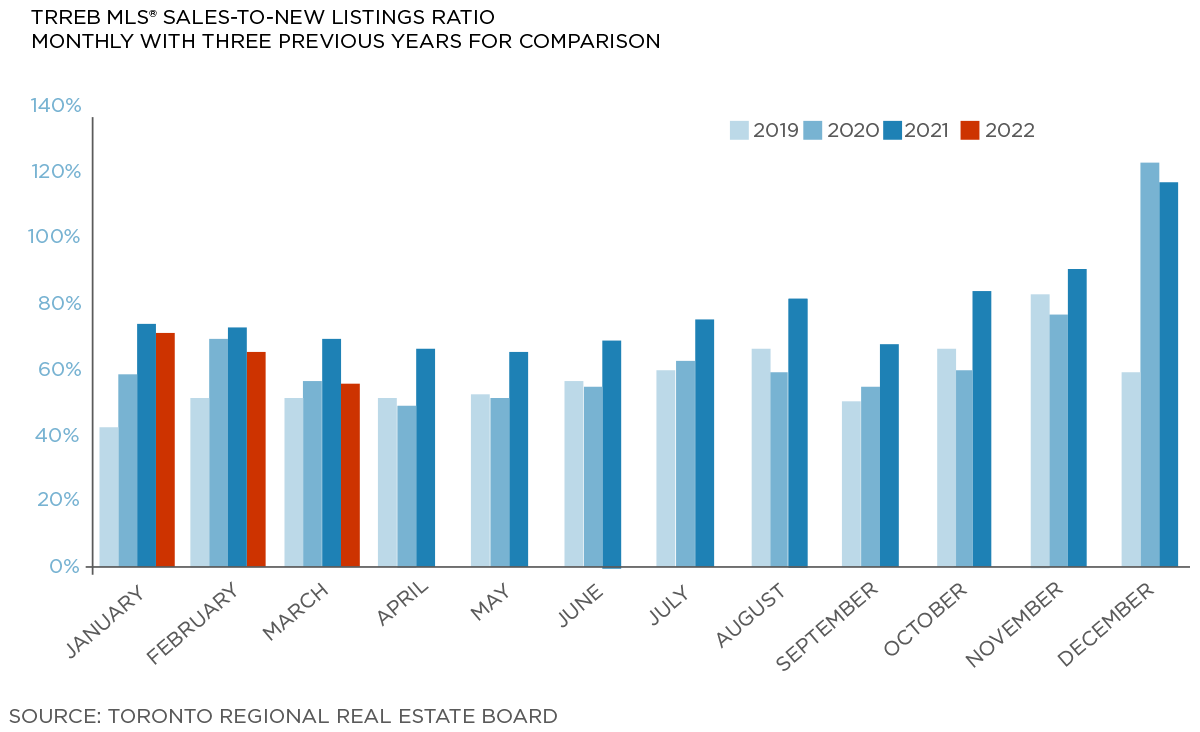

TRREB MLS® SALES-TO-NEW

LISTINGS RATIO

MONTHLY WITH 3 PREVIOUS YEARS FOR COMPARISON

Source: Toronto Regional Real Estate Board

RENTAL COMMENTARY

STRATEGIES FOR SELLERS

- Forget pricing for multiple offers. ‘Buyer fatigue’ suggests you should price atmarketvalue (defined today at the last sale price or lower – not higher).

- Staging and greatmarketingare key (photos, videos, and Open Houses).

- The first offer may well be your best offer. Get an agent who knows how to negotiate.

- If you don’t like the currentmarket, then wait until September to sell.

STRATEGIES FOR BUYERS

- Get a ‘rate hold’ when pre-qualifying for mortgage. The maximum time is 120 days. If you don’t have a ‘rate hold’, get one now! It costs you nothing and if rates are lower when you go to close, you get the lower rate.

- Go ‘variable’ rather than a ‘fixed’ rate mortgage. Even with the 50bps increase, these rates are still 1.5% lower than fixed. With variable, the ‘stress test’ qualifying rate will be 5.25%. With a fixed rate, it will be that rate plus 2%. Can you get a five-year fixed for less than 3.25%? Probably not.

- On a million-dollar property, if interest rates increase by 1%, then the property’s price would have to drop by $100,000 just to keep the same monthly mortgage payments. What scenario seems more likely?

RENTAL COMMENTARY

While multiple offers are fast disappearing in the resale market, they are starting to appear in the rental market. This can be traced to several factors. Those tenants who secured a unit during Covid at below market rents are not moving as they will enjoy the cover of rent controls which reduces the normal turnover of units. Secondly, post graduate students are returning to the downtown core and need accommodation. Finally, you will see people who moved out of town, thinking that they can work remote, being forced into some form of hybrid work and they will need a pied-a-terre downtown.When we look at the ‘active’ or available properties to lease, there is just a one-month supply for all condo sizes. Currently, there are 1579 units to lease and in March there were 2052 units leased.

AVERAGE RENT IN MARCH 2022