SALES COMMENTARY

What can you say about sales on the Toronto Regional Real Estate Board for March? At 15,652 sales, this is a single month record. You can see the six biggest sales months on TRREB in the past six years in Table 1 below.

What can you say about sales on the Toronto Regional Real Estate Board for March? At 15,652 sales, this is a single month record. You can see the six biggest sales months on TRREB in the past six years in Table 1 below.So, what happens next? We have already seen a slowing in the first ten days in April. Instead of 40 Showings on a listing and 5 Offers, we are now seeing 10 Showings and 2 Offers. Is this just a pause or the start of ‘Buyer Fatigue’?

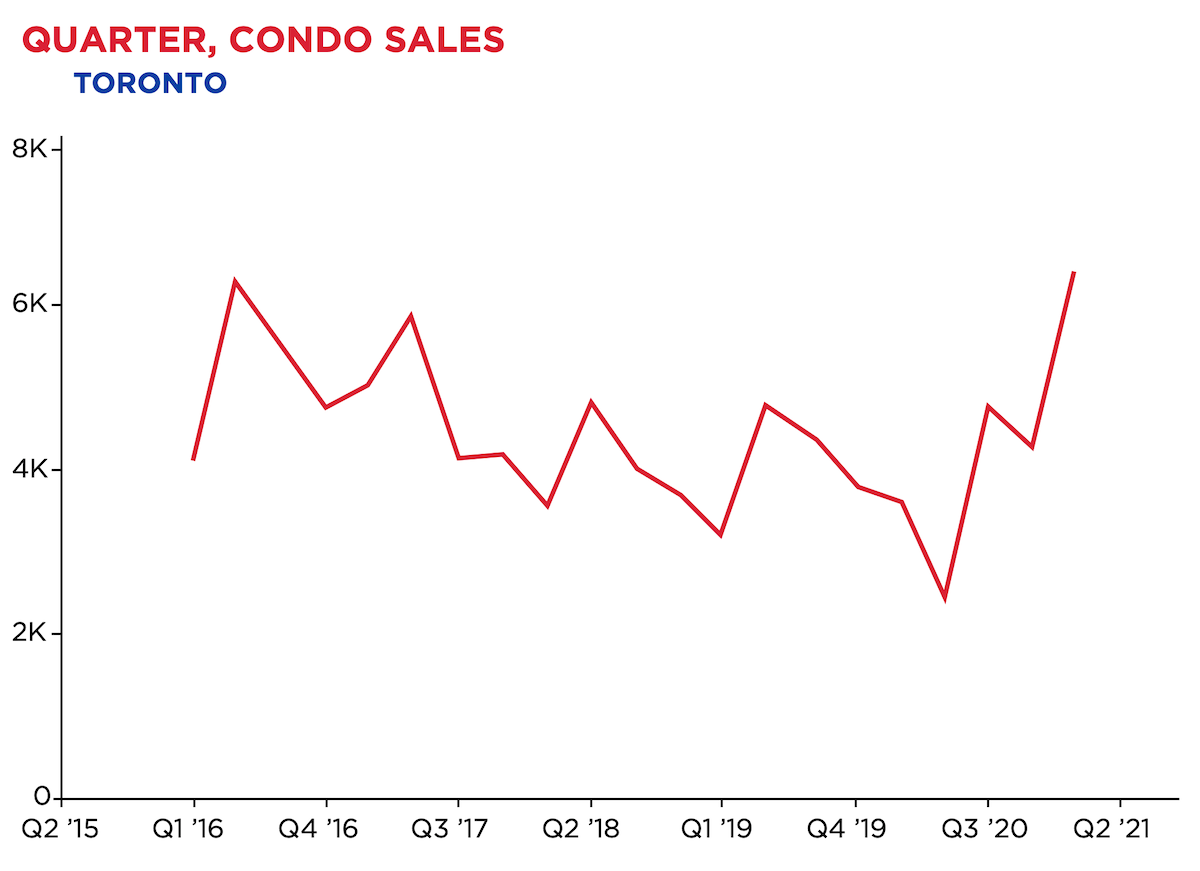

New listings in March were 22,709 or 57% higher than in March of last year. There is now more product available. But still the sales-to-new listing ratio is at 69%. This is a sign that prices will continue to increase in the short term. The hardest hit market in 2020 was the Downtown condo market. That too has recovered with a sales-to-new listing ratio of 77% in March.

The Government’s only suggestion to curb this price explosion is to tinker with the ‘Stress Test” (the rate at which you need to qualify at, but not what you will borrow at) by increasing this rate for uninsured mortgages. Currently, this rate is at 4.79% and it is proposed to be 5.25%. Why isn’t the Government concerned with its exposure to insured mortgages through CMHC? Raising the test is simply to help bank profits and not to help consumers. Does anyone believe that mortgage rates will be at these rates in five years and that homeowners with at least 25% equity will ever default?

TABLE 1: SIX BIGGEST SALES MONTHS ON TRREB IN THE PAST SIX YEARS

Source: Toronto Real Estate Board

Source: Toronto Real Estate BoardWHAT TO LOOK FOR OVER THE BALANCE OF 2021

With this crazy market, there is no need to look at past sales results. We need to focus on the impact of the following four changes coming this year.- The Government (OSFI) intends to raise the ‘stress test’ to qualify for uninsured mortgages to 5.25% from 4.79% for June 1st. The impact will be to bring more buyers forward in the short term. Long term this will have minimal impact on the market.

- The vaccine roll out is critical to getting people back into central Toronto and into offices. It looks like this will not be a significant factor until September. Expect a slowing Summer market and a strong Fall market.

- The Government is still committed to 400,000 immigrants in 2021 with many of these settling in Toronto. When will they arrive? Our guess is the latter half of the year.

- People who moved farther out of Toronto will find that their employers will require some office work and a need to appear if one is looking for a promotion. The ‘pied-a-terre’ market, either buying or renting will be active by September.

Source: Toronto Real Estate Board

Source: Toronto Real Estate Board Source: Toronto Real Estate Board

Source: Toronto Real Estate BoardRENTAL COMMENTARY

Without any international students or corporate renters, it is surprising how fast condo rental inventory has diminished. Looking at the Downtown and Humber Bay markets, we see that at the April mid-point, we have 3565 active/available leases and 1077 units leased. Compare that to March where 2875 units were leased and 2262 in February.When the vaccine roll out is complete, we expect to see corporate rentals return and also many of the 100,000 International post secondary students who will fill out the remaining inventory.

Already we are seeing rents for vacant units increase by $50/month. By September, those tenants who stay in their units will see that their rents will be $200 under market. This will create a two-tier system which is not beneficial to the overall market.